Loading

Get W 8ben Florida Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 8ben Florida Form online

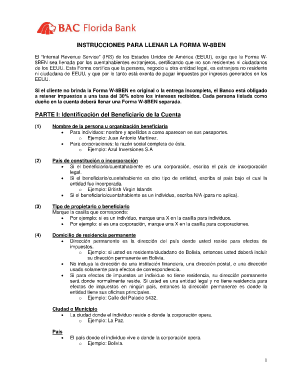

The W 8ben Florida Form is essential for foreign account holders to certify their non-residency and avoid unnecessary taxation on income generated in the United States. This guide will assist you in completing the form accurately and efficiently online.

Follow the steps to fill out the form correctly.

- Use the ‘Get Form’ button to access the W 8ben Florida Form and open it in your preferred document editor.

- In Part I: Identification of the account beneficiary, enter the name of the individual or organization as it appears on their passport or official documents. For individuals, include both first and last names (e.g., Juan Antonio Martinez). For corporations, list the full legal name (e.g., Azul Inversiones S.A.).

- Still in Part I, indicate the country of incorporation. If applying as a corporation, write the country of legal incorporation, while individuals should mark this field as N/A.

- Select the type of owner or beneficiary by marking the appropriate box — either for individuals or corporations.

- Fill in your permanent residence address, which should be the address where you reside for tax purposes. Do not include a financial institution address or a P.O. Box. If you do not have a tax residence, use the address where you normally reside.

- Provide your postal address only if it differs from the permanent residence address you supplied in the previous step.

- In the tax identification number section for the United States, if you are not a resident or citizen, simply enter N/A.

- If applicable, fill in your foreign taxpayer identification number issued by your country of residence. Otherwise, write N/A.

- Sections 9 and 10 regarding tax treaty benefits are typically irrelevant unless you believe you qualify for such benefits. If this is the case, consult the official IRS instructions.

- In Part IV: Certification, sign and date the form. If completing as a corporation, ensure that a legally authorized individual signs the form and indicates their official capacity (e.g., legal representative, president).

- After completing the form, review the information for accuracy. You can then save your changes, download the document, print it, or share it as necessary.

Begin completing the W 8ben Florida Form online today to ensure compliance and protect your financial interests.

Line 1: Enter your name. Line 2: Enter your citizenship. ... Line 3: Enter your mailing address. ... Line 5: Enter your U.S. taxpayer identification number. ... Line 6: Enter your foreign tax identifying number if you don't have an SSN or ITIN. Line 8: Enter your date of birth.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.