Loading

Get Rdt 121 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rdt 121 Form online

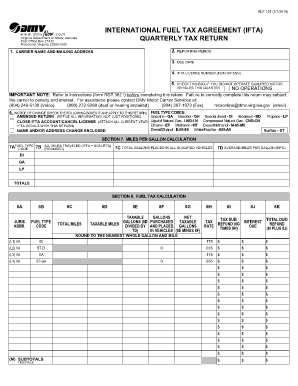

This guide provides detailed instructions on how to fill out the Rdt 121 Form, which is essential for reporting quarterly fuel taxes under the International Fuel Tax Agreement. Whether you are a first-time user or familiar with the process, this guide offers clear and supportive steps to ensure your submission is accurate.

Follow the steps to complete the Rdt 121 Form online effectively

- Click the ‘Get Form’ button to access the Rdt 121 Form, which will open in an online editor.

- Fill in the carrier name and mailing address, ensuring that all information is current and accurately reflects your business details.

- Indicate the quarterly reporting period by selecting the appropriate dates that correspond to the tax period being reported.

- Enter your IFTA license number, which may be your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- Check the relevant boxes to indicate if you did not operate tax-qualified motor vehicles this quarter or if you operated in a jurisdiction with a taxable mileage exemption. Include the jurisdiction and exemption details if applicable.

- Complete the section on the type of changes, such as fuel type codes or account closure, by checking the boxes that apply to your return.

- Proceed to calculate your miles per gallon based on the miles traveled and total gallons used in all qualified vehicles. Ensure all numbers are rounded as instructed.

- Fill out the fuel tax calculation by detailing the jurisdiction, fuel type codes, and total miles for each section, calculating taxable gallons and net tax due.

- Review the payment methods and choose how you will submit your payment. You can authorize ACH debit or indicate if you will submit payment by check or money order.

- Complete the certification section by signing and providing your printed name, email address, and contact details. Ensure the date is included for validation.

- Once all fields are completed, save your changes. You can then download or print the form for your records, or share it if necessary.

Complete your Rdt 121 Form online today to ensure compliance and avoid potential penalties.

The regional Motor Vehicle Fuels sales tax is levied on fuels sold by a distributor to a retail dealer at the FY2023 rate of 8.2 cents per gallon for gasoline and 8.3 cents per gallon for diesel fuel. Effective July 1, 2020, the tax is levied in every locality within the Commonwealth.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.