Loading

Get What Is Borrowed Respond Package Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Borrowed Respond Package Form online

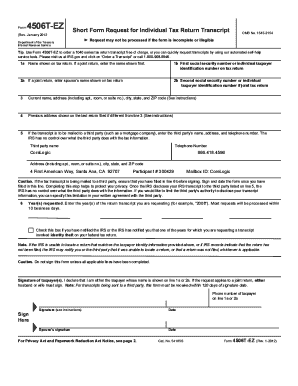

Completing the What Is Borrowed Respond Package Form is essential to apply for loss mitigation assistance. This guide provides clear, step-by-step instructions to help you navigate the form efficiently and effectively, ensuring that all necessary information is provided for processing your request.

Follow the steps to successfully complete the form

- Click the ‘Get Form’ button to access the Borrowed Respond Package Form online. This will allow you to view and fill out the form using an online editor.

- Begin by identifying the sections that require your personal information. Fill in your name, social security number, and contact details, ensuring accuracy in all entries.

- Provide the property address details. If your mailing address is the same as the property address, simply state 'same' in the relevant field.

- In the section regarding your loan number, enter the specific account number related to your mortgage, as this is crucial for identifying your request.

- Disclose your intentions regarding the property by indicating whether you wish to keep, vacate, or sell it.

- Detail your current financial situation by filling in the monthly income and expenses. Be sure to include all sources of income and required expenses as specified in the form.

- Complete the Hardship Affidavit section, providing a written explanation of your hardship along with any required documentation to support your claim.

- Once all sections of the form are filled out completely, review the information to ensure accuracy and completeness.

- Finally, save the changes made to the form. From there, you can download, print, or share the completed Borrowed Response Package Form as necessary.

Complete your Borrowed Respond Package Form online today to access potential mortgage relief options.

A larger down payment generally means you're a less risky borrower, and a less risky borrower means a lower interest rate. A lower interest rate will help you save on your monthly payment and allow you to pay less interest over the life of the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.