Loading

Get Oregon Lodging Tax Quarterly Return 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

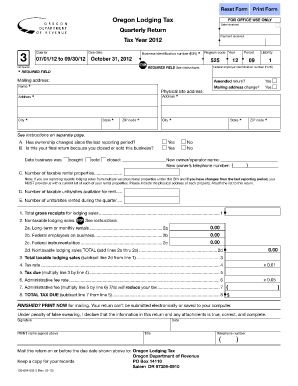

How to use or fill out the Oregon Lodging Tax Quarterly Return 2012 Form online

Filling out the Oregon Lodging Tax Quarterly Return 2012 Form online can seem overwhelming, but with clear instructions and a step-by-step approach, you can easily navigate this process. This guide will help you understand each section of the form while ensuring compliance with state regulations.

Follow the steps to complete your lodging tax return effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin by entering your Business Identification Number (BIN). This unique identifier is crucial for processing your return correctly.

- Complete the fields under 'Mailing address' and 'Physical site address'. Ensure all information is accurate to avoid delays.

- Indicate if ownership has changed since the last reporting period by checking 'Yes' or 'No'. Provide details if applicable.

- Answer the questions about whether this is your final return. If so, provide the closing or selling date of the business.

- Enter the number of taxable rental properties and units/sites available for rent during the quarter.

- Fill out the total gross receipts for lodging sales in the designated field, including any related fees.

- Complete the section for nontaxable lodging sales, providing details for long-term rentals, federal employees, or federal instrumentalities.

- Calculate the total taxable lodging sales by subtracting nontaxable sales from gross receipts.

- Complete the section for the administrative fee and calculate the total tax due by subtracting the administrative fee from the tax due.

- Print, sign, and date your return. Avoid using red ink, and don’t staple attachments.

- Mail your completed return to the Oregon Department of Revenue by the due date indicated at the top of the form.

We encourage you to complete your lodging tax return online today for efficient processing.

The state lodging tax is currently 1.5 percent of the consideration charged for occupancy of transient lodging.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.