Loading

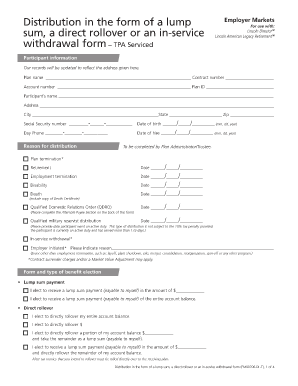

Get Distribution In The Form Of A Lump Sum, A Direct Rollover Or An In-service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Distribution In The Form Of A Lump Sum, A Direct Rollover Or An In-service online

This guide provides a clear and structured approach to filling out the Distribution In The Form Of A Lump Sum, A Direct Rollover Or An In-service online. It aims to assist individuals with various levels of experience in completing the necessary fields accurately and effectively.

Follow the steps to complete your form accurately online.

- Select the ‘Get Form’ button to access the Distribution In The Form Of A Lump Sum, A Direct Rollover Or An In-service form.

- Provide your participant information, including the plan name, contract number, account number, and plan ID. Ensure your personal details, like your name, address, Social Security number, and date of birth, are entered accurately.

- Indicate your reason for distribution. Choose from options such as plan termination, retirement, employment termination, disability, or death, and provide the relevant dates as instructed.

- In the benefits election section, choose your preferred payment method: lump sum payment, direct rollover, or a combination of both. Specify the amounts as required.

- Complete the voluntary tax withholding election. Consult with a tax advisor regarding the withholding percentage suitable for your situation.

- Provide the vesting information, including hours worked and outstanding loans if applicable. Confirm whether the distribution contains after-tax or Roth dollars.

- Fill out the payment instructions for where you want your funds to be sent, including electronic transfer details if opting for that method.

- Complete the necessary signatures, confirming that all information provided is accurate. Include witness signatures if required.

- Review all sections for completeness, ensuring accuracy in the provided information and signatures.

- Once satisfied, save, download, print, or share the completed form as needed.

Start the process of filling out your distribution form online today.

Distributions that can be rolled over are called "eligible rollover distributions." Like all retirement plans or IRA distributions, rollover distributions are reported to the taxpayer on the source document 'Form 1099-R - Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.