Loading

Get Nc5 Web 2001 - Nc Department Of Revenue - Dor State Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC5 Web 2001 - NC Department Of Revenue - Dor State Nc online

This guide provides a detailed overview of how to complete the NC5 Web 2001 form for the North Carolina Department of Revenue. It aims to assist users in easily navigating through the form online, ensuring accurate completion and timely submission.

Follow the steps to successfully complete your NC5 Web 2001 form online.

- Press the ‘Get Form’ button to access the NC5 Web 2001 form and open it in your editor for completion.

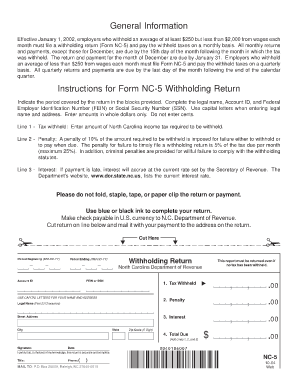

- Clearly indicate the tax period covered by this return in the specified blocks. Make sure to use capital letters for the legal name and address.

- Locate the field for Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Enter this information without any formatting errors to avoid delays.

- On Line 1, specify the amount of North Carolina income tax that has been withheld. Only whole dollar amounts should be entered; do not include cents.

- For Line 2, calculate the penalty if applicable. Remember, a penalty of 10% applies if there was a failure to withhold or pay taxes when due. Also include potential filings penalties on this line, which is 5% monthly of the tax due, capped at 25%.

- On Line 3, provide the interest amount in case of late payment. You can find the current interest rate on the Department’s website.

- Ensure that all amounts are correct. For Line 4, total the amounts from Lines 1, 2, and 3 to determine the total due.

- Sign and date the form where indicated, certifying that the information provided is accurate and complete. Include your title and phone number in the provided fields.

- Finally, save your changes, then download, print, or share the completed form. Make certain to prepare the return for mailing as instructed, without folding or stapling.

Complete your NC5 Web 2001 form online today to ensure compliance with North Carolina withholding regulations.

Related links form

General Information. For general information contact us at 1-877-252-3052. Individual Income Tax Refund Inquiry. If you have a tax refund inquiry, contact us at 1-877-252-4052. Electronic Services. For help with electronic services contact us at 1-877-308-9103. Excise Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.