Loading

Get Examples Pay Stubs As A Teacher Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Examples Pay Stubs As A Teacher Form online

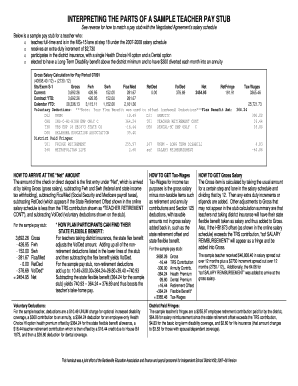

This guide provides a thorough overview of how to complete the Examples Pay Stubs As A Teacher Form online. By following these steps, users can ensure that all necessary information is accurately entered and submitted.

Follow the steps to fill out the Examples Pay Stubs As A Teacher Form.

- Click the ‘Get Form’ button to obtain the form and access it in a user-friendly online environment.

- Begin by entering your personal information, including your name, position, and any relevant identification numbers. This information is crucial for ensuring the pay stub is correctly associated with your employment.

- Next, input your gross salary. This is typically based on your annual salary divided by the number of pay periods in a year. For example, if your annual salary is $40,808.40, you would enter $3,400.70 for each monthly pay stub.

- Include any additional income, such as extra duty increments. Make sure to accurately calculate the amount based on your compensation agreements.

- Enter your deductions, including federal and state tax withholdings, Social Security and Medicare contributions, as well as any voluntary deductions such as retirement contributions or insurance premiums.

- After all deductions are accounted for, calculate your net pay by subtracting the total deductions from your gross salary.

- Finally, review the entire form for accuracy. Once you are confident that all information is correct, you can save your changes, download the document, print it for your records, or share it as needed.

Complete your Examples Pay Stubs As A Teacher Form online today for a seamless documentation experience.

Company name and address. Employee name, address and Social Security number. Gross and net earnings. Hours worked and the hourly rate for the pay period. Start and end date of the pay period. Health insurance and other deductions. Employee contributions. Taxes withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.