Get This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records online

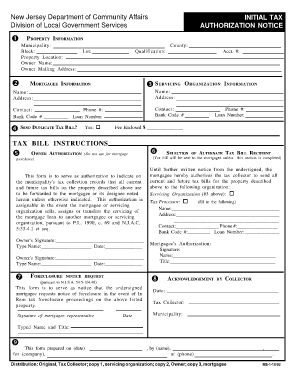

Filling out the This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records is an important step for property owners wishing to authorize the delivery of tax bills to their mortgagee. This guide will provide you with clear, step-by-step instructions to complete the form effectively and efficiently online.

Follow the steps to complete the authorization form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the required property information. This includes Municipality, Block, Lot, Property Location, Owner Name, Owner Mailing Address, and County. Ensure all details are accurately filled to reflect the correct property.

- Fill out the mortgagee information by entering the name, address, contact details, and bank code for the mortgagee. Double-check that all information is current for the recipient of the tax bills.

- In the owner authorization section, read the declaration regarding the forwarding of tax bills to the mortgagee. After understanding the terms, provide your signature, type your name, and enter the date.

- If applicable, fill out the foreclosure notice request section by signing and providing any necessary contact information.

- Complete the selection of the alternate tax bill recipient section if you wish the tax bill to be sent elsewhere. Provide the organization name, address, contact, phone number, bank code, and loan number.

- Obtain the necessary signatures from the mortgagee's representative, if required. Ensure their name, title, and signature are provided.

- After completing the form, review all fields to ensure accuracy. Once confirmed, you can save your changes, print the form, or share it as needed.

Complete and submit your authorization form online to ensure your tax records are updated accordingly.

AN ACT to provide for the assessment of rights and interests, including leasehold interests, in property and the levy and collection of taxes on property, and for the collection of taxes levied; making those taxes a lien on the property taxed, establishing and continuing the lien, providing for the sale or forfeiture ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.