Loading

Get Form T776

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form T776 online

Form T776 is essential for individuals reporting rental income in Canada. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to complete Form T776 online successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing. You will be presented with the blank Form T776, ready for you to fill out.

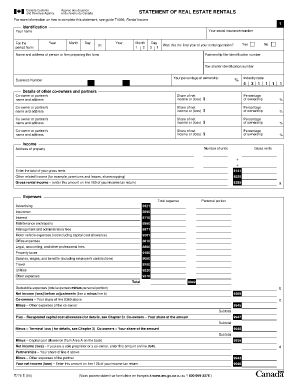

- Begin with the identification section. Enter your social insurance number and name. Indicate the rental period by filling in the appropriate year, month, and day fields for both the start and end dates.

- Indicate whether this was the final year of your rental operation by selecting 'Yes' or 'No'. Fill in the name and address of the person or firm preparing the form, if applicable.

- If you are part of a partnership, provide the partnership filer identification number, tax shelter identification number, and your percentage of ownership.

- List the details of other co-owners and partners. For each co-owner or partner, include their name, address, share of net income or loss, and percentage of ownership.

- Move to the income section. Enter the number of units and the address of the rental property. Record the gross rents and any other related income, such as premiums or leases, to calculate your gross rental income.

- In the expenses section, list all applicable expenses such as advertising, insurance, interest, maintenance, and others. Make sure to consider the personal portion if applicable, and calculate the total deductible expenses.

- Calculate your net income or loss before adjustments by subtracting your total deductible expenses from your gross rental income. If you are a sole proprietor or a co-owner, enter this amount in the designated section.

- Continue to the capital cost allowance section. Document your capital costs and any additions or dispositions made during the year.

- Once all sections are filled out, review the form for accuracy and completeness. You can then save your changes, download the form, print it, or share it according to your needs.

Complete your Form T776 online to ensure accurate rental income reporting.

What Happens If I Don't Claim Rental Income? If you fail to pay taxes as a Canadian resident receiving rent, or a non-resident receiving rent then the total amount owed will be subject to interest. The CRA will implement the penalties and fines on you for not filing taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.