Loading

Get 228 S Filler Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 228 S Filler Form online

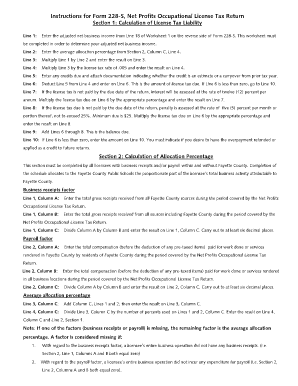

The 228 S Filler Form is essential for calculating your net profits occupational license tax. This guide will provide you with clear and supportive instructions to ensure you complete the form accurately online.

Follow the steps to successfully fill out the 228 S Filler Form online.

- Press the ‘Get Form’ button to access the 228 S Filler Form in your online editor.

- Begin with Section 1, where you will calculate your license tax liability. Start by entering your adjusted net business income from Line 18 of Worksheet 1, which is located on the reverse side of the form.

- Next, input the average allocation percentage from Section 2, Column C, Line 4.

- Multiply the amount on Line 1 by the figure on Line 2 and enter the result on Line 3.

- Take the amount from Line 3 and multiply it by the license tax rate of .005, then enter this on Line 4.

- If you have any credits due, enter them on Line 5, ensuring you attach documentation to indicate whether the credit is an estimate or a carryover from a prior tax year.

- Deduct the amount on Line 5 from the total on Line 4 and enter it on Line 6, which represents the amount of license tax due. If this amount is less than zero, move to Line 10.

- For any late payment, interest will apply. Multiply the license tax due on Line 6 by twelve percent and enter the result on Line 7.

- If the tax is unpaid by the due date, a penalty will accrue. Multiply the license tax on Line 6 by five percent per month and enter this on Line 8.

- Sum the amounts from Lines 6 through 8 and enter this total as the balance due on Line 9.

- If the amount on Line 6 is negative, enter that amount on Line 10, indicating if you wish for the overpayment to be refunded or applied as a credit for future returns.

- Proceed to Section 2 to calculate your allocation percentage, starting with the business receipts factor. Input your total gross receipts from Fayette County sources on Line 1, Column A.

- Then, enter the total gross receipts from all sources on Line 1, Column B.

- Divide Column A by Column B and enter the result on Line 1, Column C.

- Move on to the payroll factor by entering total compensation paid for work done in Fayette County on Line 2, Column A.

- In Column B, enter the total compensation paid for work rendered across all business locations.

- Divide Column A by Column B and enter that result in Column C.

- For Column C, Line 3, add Lines 1 and 2 and enter the total.

- Finally, divide the total on Line 3 by the number of percentages used on Lines 1 and 2, and enter that in Line 4, Column C and Line 2 of Section 1.

- Make sure to save changes, download, print, or share the form as needed.

Complete your 228 S Filler Form online today for accurate and timely submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.