Loading

Get Kentucky Schedule M Printable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Schedule M Printable Form online

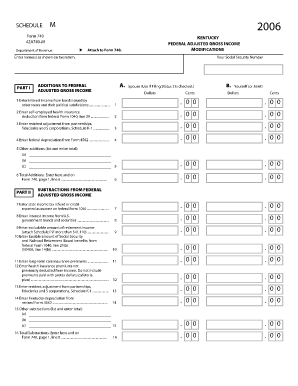

Completing the Kentucky Schedule M Printable Form is essential for accurately reporting adjustments to your federal adjusted gross income. This guide provides clear, step-by-step instructions to help you fill out the form online with confidence.

Follow the steps to complete the Kentucky Schedule M Printable Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your name(s) as shown on your tax return at the top of the form. Additionally, input your Social Security number in the designated field.

- In Part I, labeled Additions to federal adjusted gross income, provide the necessary figures in dollars and cents for each item as applicable. This includes interest income from bonds issued by other states (line 1) and self-employed health insurance deductions (line 2). Ensure that you accurately complete all entries, including any required additional information for lines 5 and 6.

- Total your additions at the end of Part I by adding the specific figures. Enter this total in the designated field, which you will also reference on Form 740, page 1, line 6.

- Proceed to Part II, Subtractions from federal adjusted gross income. Similarly, input the relevant amounts for each item such as the excludable amount of retirement income (line 9) and taxable Social Security benefits (line 10).

- List any other subtractions in the provided fields (line 15) and calculate the total subtractions. Enter this total in the designated field and reference it on Form 740, page 1, line 8.

- Review the completed form for accuracy. Once you are satisfied that all entries are correct, you can save any changes, download the form, print it out, or share it as needed.

Start filling out your Kentucky Schedule M Printable Form online today for a smooth filing experience.

You may be exempt from withholding for 2021 if both the following apply: • For 2020, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. • For 2021, you expect a refund of all your Kentucky income tax withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.