Loading

Get T2091

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2091 online

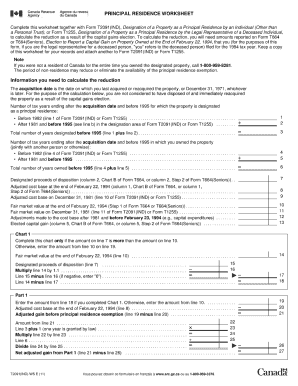

The T2091 form is an important document used for reporting the sale of a principal residence for tax purposes. This guide provides clear and concise instructions to help you successfully fill out the form online, ensuring that you provide the necessary information correctly.

Follow the steps to complete the T2091 form online effectively.

- Press the ‘Get Form’ button to access the T2091 form and open it in the digital editor.

- Begin by entering your personal information, including your full name, current address, and contact details as required in the first section of the form.

- In the next section, provide details about the property, such as the address of the residence you are reporting and the period you lived in it as your principal residence.

- You will also need to report any changes in ownership interest during the period of ownership. Fill out this section carefully and ensure all figures are accurate.

- Complete the section on the calculations for any capital gains or losses incurred from the sale. You will need to provide information about the selling price, purchase price, and any adjustments.

- Carefully review all entries for accuracy, ensuring that all required fields are complete and correctly filled out.

- Once you have verified that all sections of the T2091 form are accurately filled out, you can save changes, download, print, or share the completed document based on your needs.

Complete your T2091 form online today for accurate reporting.

So, if you designate a property you've owned for 10 years as your principal residence for two years, you could actually shelter 30% of the capital gains under the principal residence exemption (2 years + 1 freebie year), according to the CRA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.