Loading

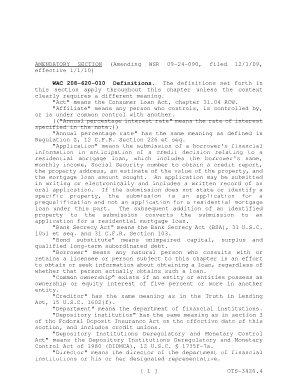

Get Rate Lock Agreement Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rate Lock Agreement Requirements online

This guide provides a clear and supportive overview of the Rate Lock Agreement Requirements, helping users navigate the process of filling out the form online. By following these steps, you can ensure that you complete the agreement accurately and efficiently.

Follow the steps to complete the Rate Lock Agreement Requirements form.

- Click the ‘Get Form’ button to obtain the Rate Lock Agreement Requirements form and open it in your preferred online document editor.

- Begin with the borrower section, where you will need to enter the borrower's full name, contact information, and Social Security number. This information is crucial for verifying the identity of the borrower.

- Next, provide the property address where the mortgage will be secured. This ensures that the agreement applies to the correct property.

- In this section, detail the loan amount being sought by the borrower, which is essential for establishing the parameters of the rate lock.

- Indicate the interest rate you wish to lock, along with any relevant details regarding the loan terms. Make sure to specify whether the rate lock is guaranteed and any applicable fees.

- Enter the details regarding the lock period, specifying how long the rate will be locked in, and include the expiration date of the lock agreement.

- Review all entered information for accuracy. Make any necessary corrections to ensure that all details are correct before finalizing the document.

- Once you have confirmed that all information is accurate, you can save changes to the form, and choose to download, print, or share the document as needed.

Start filling out your Rate Lock Agreement Requirements form online today to secure the best terms for your mortgage.

You can't unlock your mortgage rate after locking. But there may be other ways to get a lower rate after you've locked. However, the agreement works both ways. If rates suddenly fall, you can't just back out of the rate lock and expect your lender to offer you a lower interest rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.