Loading

Get St556 Amended Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St556 Amended Form online

Filling out the St556 Amended Form online can help streamline your tax return process and ensure that any corrections or changes are properly submitted. This guide provides clear, step-by-step instructions to assist you in accurately completing the form.

Follow the steps to successfully complete the St556 Amended Form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

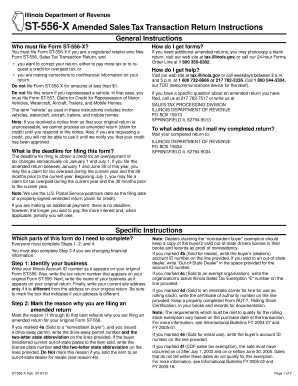

- Identify your business by entering your Illinois Account ID number as it appears on your original Form ST-556. Include the tax return number from the original form and your business name. If your current site address differs from the original, enter the new address and mark the appropriate box.

- Mark the reason for filing the amended return from the provided options. Include any required information based on the reason selected, such as permit or account ID numbers. Attach additional sheets if necessary for explanations.

- If you are correcting financial information, input the amounts as per your most recent return. Use whole dollar amounts, making sure to report taxes and any credits appropriately. Include any additional payments if required.

- Complete Step 4 by signing the form as an authorized person. Ensure the signature is legible and meets the necessary criteria for processing.

- Once all sections of the form are filled out, review your entries for accuracy. Save your changes, and then download or print the completed form for your records.

- You may now share or submit your amended return as needed, ensuring to follow any local mailing instructions if required.

Take the next step and complete your St556 Amended Form online today!

“Exclusively charitable,” religious or educational organizations, governmental bodies, and schools can be exempt from sales tax. To obtain an exemption, an organization must apply for an IDOR-issued identification number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.