Loading

Get Tcac Income Calculation Exercise

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tcac Income Calculation Exercise online

This guide provides step-by-step instructions on filling out the Tcac Income Calculation Exercise online. The exercise aids in understanding income calculations for housing eligibility, ensuring clarity and compliance for users.

Follow the steps to complete the Tcac Income Calculation Exercise.

- Click ‘Get Form’ button to obtain the document and open it in your preferred online editor.

- Begin by carefully entering your personal information in the designated fields, including your name and contact information. Ensure this information is accurate to avoid any processing issues.

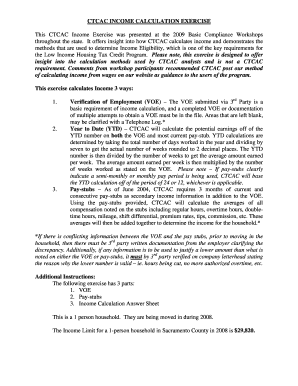

- Complete the Verification of Employment (VOE) section by providing the employer's name, address, and contact information. Your signature authorizing the release of your employment information will also be required here.

- Input your current wages or salary in the provided fields, ensuring you indicate the frequency of payment, such as hourly or yearly. This information will help in calculating your total income.

- List your year-to-date (YTD) earnings as stated on your pay stubs and VOE. This should reflect the total earnings for the year including any overtime or bonuses.

- If applicable, detail any additional income such as commissions or bonuses and ensure to clarify the payment frequency.

- After completing all sections, review your entries for accuracy. Then, save your changes. You may choose to download, print, or share the completed form as needed.

Encourage other users to complete their documents online for a streamlined experience.

To qualify for admission, applicants must fall within the unit's income limits. This is usually 50% or 60% of the AMI (Area Median Income). In addition, LIHTC owners cannot discriminate against voucher families and must accept Section 8 voucher tenants.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.