Loading

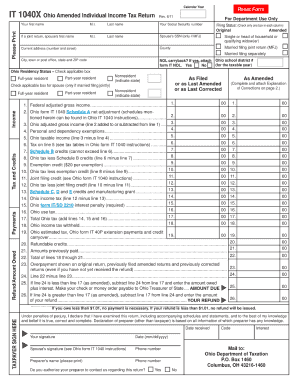

Get 2010 Ohio It 1040x Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Ohio It 1040x Instructions Form online

Filling out the 2010 Ohio It 1040x Instructions Form online can be a straightforward process when you have the right guidance. This comprehensive guide will walk you through each section, ensuring you can correctly complete the form and submit it efficiently.

Follow the steps to accurately fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with section A, where you will provide your personal information, including your name, address, and Social Security number. Ensure that all details are accurate, as this information will be used to process your tax return.

- Move to section B to indicate the tax year for which you are amending your return. Enter '2010' if you are working on the 2010 Ohio It 1040x Instructions Form.

- In section C, outline the changes you are making to your original tax return. This may involve adding, removing, or correcting figures from your previous filing. Be precise when entering new amounts, as this will impact your overall tax calculation.

- Proceed to section D to summarize any additional information or explanations regarding the changes you are making. It is important to clarify the reasons for your amendments to avoid potential issues with the tax authorities.

- After completing all required sections, review the form to ensure all information is accurate and complete. It is vital to double-check your entries before finalizing the document.

- You can now save your changes, download, print, or share the completed form, depending on your preferred method of submission.

Start filling out your 2010 Ohio It 1040x Instructions Form online today for a seamless experience.

Amending your tax return does not increase your chances of being audited. You may be entitled to a larger refund when you amend your return. Correcting mistakes with an amended return can save interest and penalties on issues the IRS would catch anyway.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.