Loading

Get Fc 34 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fc 34 Form online

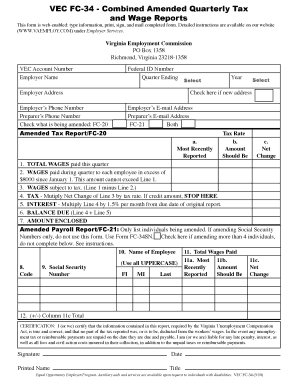

The Fc 34 Form is a vital document for employers to report tax and wage information quarterly. This guide provides clear, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to accurately complete the Fc 34 Form online

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Fill in your VEC account number and employer name at the top of the form. Ensure that your details are accurate to avoid any issues.

- Input your federal ID number and the quarter ending date. This information is crucial for proper identification of your report.

- Provide the employer's address and phone number, along with the preparer's details if applicable. You may also include the employer's and preparer's email addresses.

- Indicate what is being amended by selecting the appropriate checkboxes for the FC-20 or Amended Tax Report.

- List the total wages paid this quarter as well as amounts exceeding $8000 for each employee since January 1, ensuring total wages do not exceed Line 1.

- Calculate the wages subject to tax by subtracting the wages paid during the quarter to each employee in excess of $8000 from the total wages.

- Determine the tax amount by multiplying the net change of the wages subject to tax by the tax rate and proceed to Line 5 for interest calculation if required.

- Calculate the total balance due by adding any tax and interest amounts from previous lines.

- If applicable, provide the amount enclosed and list any amendments to employee information, ensuring details are accurate.

- Complete the certification section by signing, dating, and printing your name and title to validate your report.

- Once you have completed all sections, you can save your changes, download, print, or share the filled-out form as needed.

Start filling out your Fc 34 Form online today for an efficient reporting experience.

Related links form

Quarterly Tax and Wage Report (FC-34)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.