Loading

Get Forms Uc Cr 4 And Uc 10 R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms UC Cr 4 And UC 10 R online

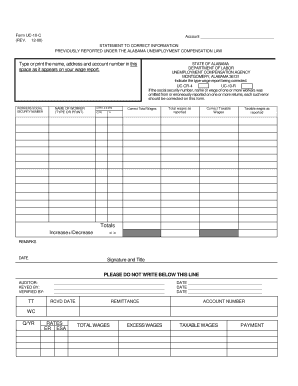

This guide provides a clear and comprehensive overview of how to fill out the Forms UC Cr 4 and UC 10 R online. Whether you are correcting previously reported information or ensuring accurate reporting for unemployment compensation, following these steps will simplify the process.

Follow the steps to complete the forms accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Input the account name, address, and account number exactly as it appears on your wage report. Ensure all information is legible.

- Fill in the worker's social security number and name by typing or printing clearly.

- Indicate the quarter for which you are correcting information (1, 2, 3, or 4). Select the type of wage report being corrected by checking the appropriate box for UC CR-4 or UC-10-R.

- If there are errors concerning the worker's social security number, name, or wage, make the necessary corrections directly on this form, providing details for each error.

- In the 'Correct Total Wages' section, enter the corrected total wages for the worker. In the adjacent field, provide the total wages as previously reported.

- Complete the 'Correct Taxable Wages' and the 'Taxable Wages as reported' sections similarly to provided details for total wages.

- Review the calculations for the 'Totals Increase+/Decrease' section ensuring that any adjustments are documented accurately.

- Provide additional remarks if necessary in the 'REMARKS' section, explaining any changes or corrections made.

- Finally, add the date, and include your name and title in the signature area. Make sure all information is accurately filled before finalizing.

- After reviewing the entire form for accuracy, you can save changes, download, print, or share the completed form as necessary.

Start filling out your forms online today for a seamless submission experience.

New Hire Paperwork: Alabama Alabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4. ... Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.