Loading

Get Nt St3nr Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nt St3nr Tax Form online

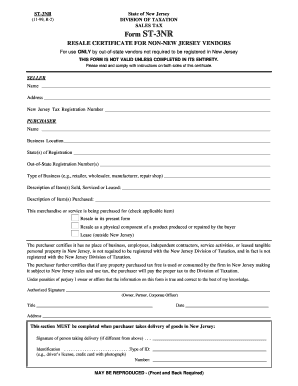

The Nt St3nr Tax Form is a resale certificate specifically designed for non-New Jersey vendors. Completing this form accurately is crucial for out-of-state vendors who wish to make tax-exempt purchases in New Jersey. This guide provides a clear, step-by-step approach to filling out the form online.

Follow the steps to complete the Nt St3nr Tax Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the seller's name in the designated field. Ensure this is the legal name of the business or individual selling the goods.

- Provide the seller's address including the street, city, state, and zip code in the corresponding fields.

- Input the New Jersey tax registration number of the seller if available. This is important for verifying tax exemptions.

- In the section for purchaser information, input the purchaser's name accurately.

- Fill in the business location of the purchaser, indicating the address where the business operates.

- List the state(s) of registration for the purchaser along with the out-of-state registration numbers.

- Select the type of business from the list provided (e.g., retailer, wholesaler, manufacturer, repair shop) in the specified field.

- Describe the items that are sold, serviced, or leased by entering a detailed description.

- Provide a description of the items being purchased. Be specific to avoid any misunderstandings.

- Check the box that corresponds to the reason for purchasing the items—whether for resale, as a component, or for lease.

- Ensure that the certification regarding having no business activities in New Jersey is acknowledged. This is a critical statement about tax obligations.

- The authorized individual (Owner, Partner, Corporate Officer) must sign the form and enter their title beneath the signature.

- Complete the date field and provide the address of the signer, ensuring accuracy.

- If applicable, include the signature and identification details of the person taking delivery of the goods.

- Once all sections are completed and verified for accuracy, save changes, then download, print, or share the completed form as needed.

Fill out the Nt St3nr Tax Form online today to ensure compliance and make your purchases tax-exempt!

You may validate any certificate that is issued by the Division and that contains a validation number under the printed seal of the State of New Jersey. For validation of a Certificate of Authority you will need to use the Document Locator Number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.