Loading

Get Notice For Prevailing Rate And Other Jobs - New York State ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice For Prevailing Rate And Other Jobs - New York State online

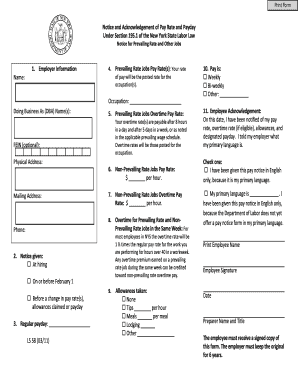

Filling out the Notice For Prevailing Rate And Other Jobs is a critical process for ensuring compliance with New York State Labor Law. This guide will walk you through each section of the form, providing clear instructions that can help you complete it effectively online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the employer information section. Provide the name of the employer, the 'Doing Business As' (DBA) name if applicable, and the physical and mailing addresses.

- Specify the prevailing rate jobs pay rates by detailing the occupations and entering the corresponding rates of pay. Remember that these rates will be the posted rate for the job.

- Indicate the prevailing rate jobs overtime pay rate, which should reflect the applicable overtime standards outlined in the prevailing wage schedule.

- If applicable, fill out the non-prevailing rate jobs pay rate and overtime pay rate, specifying the hourly amounts.

- Select the box indicating when notice is given regarding pay rate changes and complete the regular payday information.

- Mention any allowances taken, such as tips, meals, or lodging, and clearly specify the amounts if applicable.

- Choose the appropriate pay frequency (weekly, bi-weekly, etc.) in the designated section.

- Under the employee acknowledgment section, ensure that the employee reviews and understands their pay rate, overtime rate, and allowances, then sign and date the form.

- Once all fields are complete, save the changes, and choose to download, print, or share the form as needed.

Ensure you complete the forms online to facilitate and streamline your documentation process.

A salaried employee is a worker who is paid a fixed amount of money or compensation (also known as a salary) by an employer. For example, a salaried employee might earn $50,000 per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.