Loading

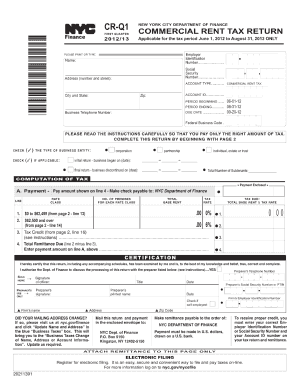

Get Nyc Cr Q4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc Cr Q4 online

Filling out the Nyc Cr Q4 form online can be a straightforward process with the right guidance. This comprehensive guide aims to provide clear instructions for each section and field to help you complete the form efficiently.

Follow the steps to complete the Nyc Cr Q4 form successfully

- Click 'Get Form' button to obtain the form and access it for editing.

- Begin by entering your relevant personal information in the designated fields. Ensure that all information is accurate and up-to-date.

- Proceed to input any financial details or data required in the subsequent sections. Review each item thoroughly to avoid errors.

- Next, fill out the supplementary information or explanation sections as required. Provide concise and clear descriptions to enhance your submission.

- Once all fields are filled out, verify the information for accuracy. Double-check for any missing items or inconsistencies.

- After reviewing, you can proceed to save your changes. Optionally, download, print, or share the completed form as needed.

Complete your documents online today for a seamless filing experience.

The New York City Commercial Rent Tax is a 6% tax imposed on rent payments by tenants who occupy or use a property for commercial purposes in Manhattan, south of 96th Street.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.