Loading

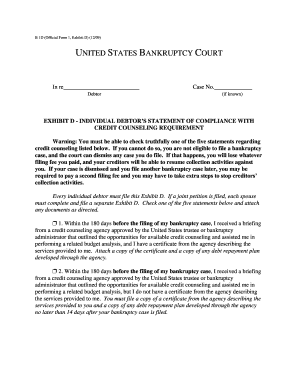

Get Official Fillable Bankruptcy Forms For Texas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Official Fillable Bankruptcy Forms For Texas online

Filling out the Official Fillable Bankruptcy Forms for Texas can seem daunting, but with this comprehensive guide, you will be able to complete the process online with confidence. Each step is designed to help you navigate the required fields and sections clearly and effectively.

Follow the steps to successfully complete your bankruptcy form.

- Click the ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Begin by filling in the debtor's name under the 'In re' section. Ensure that you accurately provide your name as it appears on official documents.

- Input the case number, if known, in the designated area. If you do not have a case number, you can leave this section blank.

- In the 'Exhibit D' section, check one of the five statements related to credit counseling. Choose the statement that accurately reflects your situation and prepare to attach the necessary documentation.

- If you received a credit counseling briefing, ensure that you attach a copy of the certificate provided to you by the agency. If applicable, include any debt repayment plan developed through the agency.

- If you selected the option that states a temporary waiver is being requested, summarize your exigent circumstances in the provided space. Be concise yet detailed enough to inform the court of your situation.

- Ensure you complete the last section by signing the document and adding the date you are completing the form. This certifies that the information you provided is correct.

- After filling out the form, you can save your changes, download the completed document, print it, or share it as needed.

Start completing your bankruptcy documents online today to take the next step towards your financial fresh start.

The moment you file your bankruptcy case, an automatic stay goes into effect. The stay prohibits almost all creditors from initiating or continuing any collection activities against you. A creditor cannot call you, send you collection letters, file a lawsuit, or otherwise attempt to collect its debt from you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.