Loading

Get Texas Resale Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Resale Certificate online

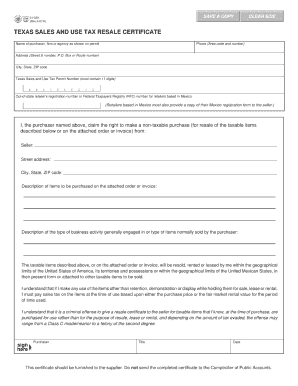

The Texas Resale Certificate is an essential document for individuals and businesses making tax-exempt purchases. This guide provides clear instructions on how to complete the certificate online, ensuring accurate and compliant submissions.

Follow the steps to fill out the Texas Resale Certificate effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the purchaser's name, and enter your full legal name as the individual or business making the purchase.

- Fill in your physical address, including the street, city, state, and zip code. Ensure that this matches your official records.

- Provide your sales tax permit number, which is essential for verification and tax exemption purposes.

- Indicate the type of property being purchased by checking the appropriate boxes that describe the items or services.

- Sign and date the document at the bottom to certify the accuracy of the information provided.

- After completing the form, review all entries for accuracy and clarity. Make necessary corrections if required.

- Finally, save your changes, download a copy, print it out for your records, or share it with the seller as needed.

Complete your Texas Resale Certificate online today to simplify your tax-exempt purchasing process.

Exempt certificates and resale certificates are very similar documents with the major difference being that an exemption certificate does not require a taxpayer ID number to be legally valid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.