Loading

Get Mississippi Form 86 105 Instructions 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mississippi Form 86 105 Instructions 2012 online

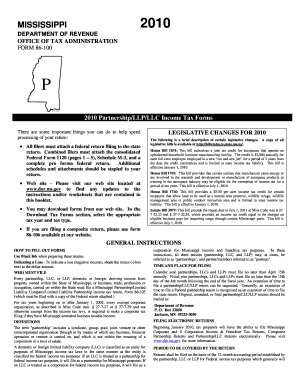

The Mississippi Form 86 105 is essential for partnerships, limited liability companies (LLCs), and limited liability partnerships (LLPs) to report income generated in the state. This guide provides a step-by-step approach to efficiently complete this form online, ensuring compliance with state regulations.

Follow the steps to complete the Mississippi Form 86 105 online with ease.

- Press the ‘Get Form’ button to access the Mississippi Form 86 105 and open it in your preferred online editor.

- Carefully enter your taxpayer information in the designated fields. Ensure that all required details, such as business name, address, and county code, are accurate. Use the provided county code table for reference.

- Indicate the type of entity by checking the appropriate box. If the entity is a partnership, LLC, or LLP, mark the respective option.

- Enter the number of partners or members as of the end of your accounting period in line 4a. Additionally, fill in the date the business commenced operations in Mississippi.

- Complete Section 5 regarding Mississippi income from Form 86-122 and provide the necessary calculations for income, deductions, and credits.

- Calculate the tax due following the guidelines outlined in the form and ensure you consider any applicable deductions and credits.

- Review all information for accuracy before finalizing the form, and ensure you have included any necessary attachments.

- Once you have completed the form, proceed to save your changes. You can then download, print, or share the completed Form 86 105 as needed.

Complete your Mississippi Form 86 105 online today for a smooth filing experience.

A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity. The franchise tax effectively charges corporations for the privilege of doing business in the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.