Loading

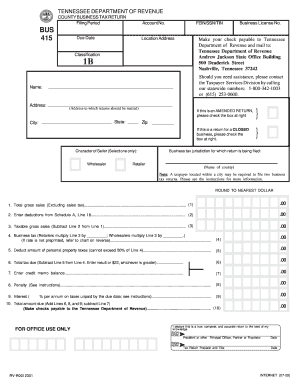

Get Tennessee Form Bus 415

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tennessee Form Bus 415 online

Filling out the Tennessee Form Bus 415 correctly is essential for business compliance in the state. This guide provides step-by-step instructions to help users navigate the online process smoothly.

Follow the steps to complete the Tennessee Form Bus 415 online effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your account number and due date to identify your business-specific information.

- Provide the FEIN/SSN/TIN of your business for tax identification purposes.

- Fill in the location address where your business operates, and include the city, state, and zip code.

- Indicate if this is an amended return or a return for a closed business by checking the appropriate boxes.

- Select the character of seller by choosing either wholesaler or retailer according to your business type.

- Complete the total gross sales line, excluding sales tax, by entering the amount of sales generated.

- Enter any deductions from Schedule A. Calculate taxable gross sales by subtracting deductions from total gross sales.

- Calculate the business tax based on the applicable multiplier for your classification and taxable gross sales.

- Deduct the amount of personal property taxes from the calculated tax, ensuring it does not exceed 50% of the total tax due.

- Determine your total tax due by applying the minimum requirement, then record any credit memo balance and penalties if applicable.

- Add all necessary lines to obtain the total amount due for payment.

- Sign the form electronically, including the date and the title of the person submitting the form.

- Once all fields are complete, save your changes, and choose whether to download, print, or share the form as needed.

Complete your Tennessee Form Bus 415 online today to ensure timely and accurate filing.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.