Loading

Get Form 415

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 415 online

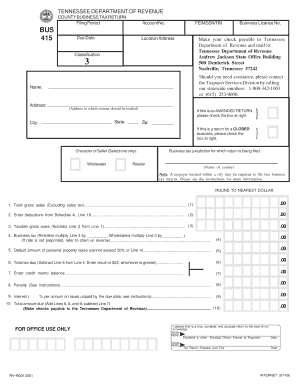

Filling out Form 415, the County Business Tax Return, online can simplify your tax reporting process. This guide will provide you with a comprehensive, step-by-step approach to complete the form accurately and efficiently.

Follow the steps to complete Form 415 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the top section, enter your account number and the filing period. Ensure the information is accurate to avoid any delays in processing.

- Provide your name, address, city, state, and zip code in the designated fields. This information is essential for identifying your business.

- Enter your Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Tax Identification Number (TIN) as required.

- Indicate if this is an amended return by checking the appropriate box.

- Select your business classification (wholesaler or retailer) and fill in the total gross sales, excluding sales tax.

- Calculate the tax due by multiplying the total gross sales by the applicable tax rate based on your classification. Enter this amount in the provided field.

- If applicable, enter deductions from Schedule A to adjust your total gross sales. This step is crucial to ensure accurate tax calculation.

- Calculate any interest and penalty, if applicable, and provide these amounts in their respective fields.

- Sum all applicable lines to determine the total amount due. Make sure to double-check your calculations.

- In the signature section, ensure the form is signed and dated by the appropriate individual, such as the principal officer or partner.

- Finally, review all information for accuracy before saving changes. You may then download, print, or share the completed form as needed.

Begin completing your Form 415 online today to ensure timely and accurate filing.

It could prevent you from attending a new school. Whether you're trying to finish a degree, transferring to a new college or applying to graduate school, transcript withholding means you could be blocked from acceptance into a new academic institution. It could hurt your job prospects.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.