Loading

Get Wg 002 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wg 002 Form online

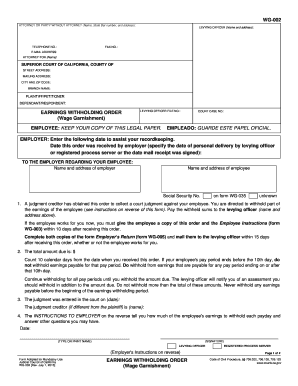

This guide provides clear, step-by-step instructions on how to complete the Wg 002 Form online. Whether you are an employer or a legal representative, the following information will help you navigate each section effectively.

Follow the steps to complete the Wg 002 Form online.

- Click ‘Get Form’ button to access the Wg 002 Form and launch it in your preferred online editor.

- Fill in the attorney or party's details, including the name, State Bar number, address, and telephone number. This information is essential for identification and communication purposes.

- Provide the levying officer's name and address along with their fax number and email address, ensuring you have accurate contact information for future correspondence.

- Identify the attorney for (Name) where applicable, followed by the details of the Superior Court of California, which includes the county name, street address, mailing address, city, zip code, and branch name.

- Enter the names of the plaintiff/petitioner and defendant/respondent. This section helps clarify the parties involved in the garnishment order.

- Complete the earnings withholding order section, including the levying officer file number, court case number, and the employee’s details such as name and address.

- Include the employee's social security number, which is necessary for proper identification and processing.

- Indicate the date this order was received by the employer, noting the specifics of personal delivery or mail receipt.

- Review the critical instructions for employers regarding payment withholding and ensure understanding of the computation instructions for employee earnings.

- Sign and date the form, typing or printing your name to validate the document before submission.

- After completing the form, you can save your changes, download the completed Wg 002 Form, or print it for your records.

Complete your documents online today for efficient management of your legal requirements.

Related links form

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.