Loading

Get Reciprocal Non Reciprocal Vehicle Tax Rate Chart 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reciprocal Non Reciprocal Vehicle Tax Rate Chart 2019 online

Completing the Reciprocal Non Reciprocal Vehicle Tax Rate Chart 2019 online is a straightforward process that requires attention to detail. This guide will provide you with clear instructions on how to fill out the chart accurately, ensuring compliance with the relevant tax regulations.

Follow the steps to complete the chart effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section of the form, which outlines the purpose and significance of the Reciprocal Non Reciprocal Vehicle Tax Rate Chart.

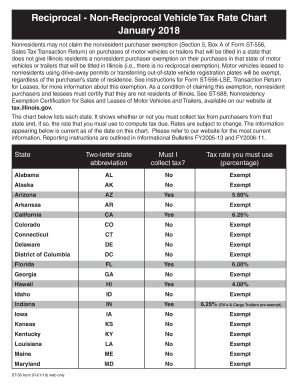

- Locate the chart section in the form. This section lists states, their two-letter abbreviations, and columns indicating whether you must collect tax from purchasers and the applicable tax rate.

- For each state listed, identify if you are required to collect tax. If the box under 'Must I collect tax?' indicates 'Yes,' refer to the corresponding tax rate percentage.

- Make sure to correctly document the tax rates in your records or calculations, ensuring you're aware of any exemptions that apply, as indicated in the chart.

- After you have completed the entries, review your work for any errors or omissions to ensure compliance with state tax regulations.

- Once you are satisfied with the entered information, you may proceed to save changes, download, print, or share the form as needed.

Complete your documents online to ensure timely compliance with state tax regulations.

Texas allows a credit for sales or use tax paid to other states.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.