Loading

Get Ct Form 0 88

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Form 0 88 online

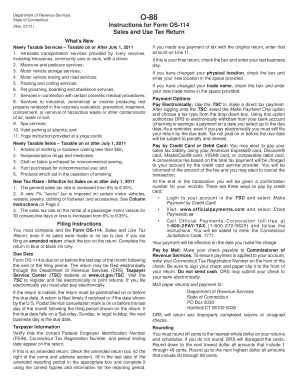

Completing the Ct Form 0 88 online is a straightforward process that can be accomplished with attention to detail. This guide will walk you through each section of the form, ensuring you have the necessary information to file accurately and efficiently.

Follow the steps to complete the Ct Form 0 88 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the taxpayer information section carefully. Ensure that your Federal Employer Identification Number and Connecticut Tax Registration Number are entered correctly. If this form is an amended return, check the appropriate box and fill in the last date of the reporting period.

- Fill in the total gross receipts from sales, ensuring to include all qualifying sales while excluding any exempt sales. Review all taxable items as listed in the instructions.

- Complete sections regarding deductions on the back of the return. Itemize all deductions accurately, as they may require certificates to support exempt sales.

- Review your payment options. Choose to pay electronically, by credit or debit card, or by mail. Ensure that the payment is made by the due date to avoid penalties.

- After completing all sections, double-check your entries to ensure accuracy. Save your changes, then download, print, or share the form as needed. Be sure to file it electronically if that is your chosen method.

Start filling out the Ct Form 0 88 online today for a seamless filing experience.

To claim exemption for the purchase of goods or taxable services, the organization must complete CERT-119, Certificate for Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations and give it to the retailer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.