Loading

Get How To Fill Out A 4506t Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out A 4506t Form online

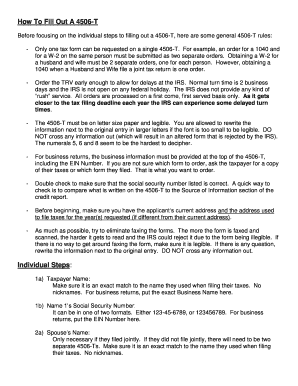

Filling out the 4506-T form online can be straightforward if you follow the correct steps. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to complete the 4506-T form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxpayer's name in the first field, ensuring it matches the name used on their tax filings exactly, avoiding nicknames.

- Input the taxpayer's Social Security Number (SSN) in either the format of 123-45-6789 or 123456789. If this is a business return, provide the Employer Identification Number (EIN) instead.

- If applicable, include the spouse’s name in the designated field, ensuring it is also an exact match to their tax filings. This is necessary only for joint filers.

- Fill in the spouse's Social Security Number in the same format as the taxpayer's SSN.

- Record the current name and address. If the taxpayer has changed their name from what is entered in previous fields, update this information here.

- Complete the previous address section only if the filing address differs from the current address listed.

- In box 5, fill in 'Accudata Credit Systems, LLC. Mailbox ID: LSTOKES42 1002 Diamond Ridge, Ste 500, Jefferson City, MO 65109'.

- Specify the tax form type requested, such as 1040, W-2, 1065, or 1099, in the corresponding field.

- Select the appropriate box for the type of transcript requested, whether it is a return transcript, account transcript, record of account, verification of nonfiling, or various forms like W-2.

- Indicate the year or period for which the transcript is being requested using either mm/dd/yyyy or just yyyy format, but avoid using mm/yyyy.

- Provide the signature of the person ordering the transcript. Ensure the signature is recognizable and matches the taxpayer's name. The form should also include the date of signing.

- After completing the form, review all entries for accuracy. Finally, save changes, download, print, or share the completed form as necessary.

Complete your forms online efficiently and accurately today.

Use Form 4506-T to request tax return transcripts, tax account information, W-2 information, 1099 information, verification of non-filing, and record of account. Customer File Number. The transcripts provided by the IRS have been modified to protect taxpayers' privacy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.