Loading

Get Bona Fide Residenceiphysical Presence ... - Taxmeless.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bona Fide ResidenceIPhysical Presence ... - TaxMeLess.com online

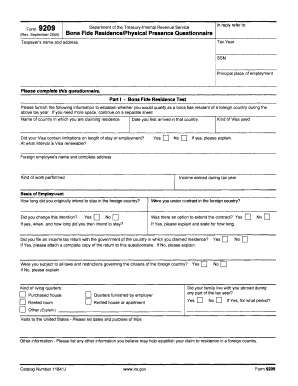

Completing the Bona Fide ResidenceIPhysical Presence form is an essential step for individuals applying for tax benefits. This guide provides clear, step-by-step instructions to help users successfully navigate the online form.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred online document editor.

- Begin by entering your personal information in the designated fields. This typically includes your full name, address, and taxpayer identification number.

- Proceed to the section regarding your bona fide residence or physical presence. Specify the dates you have lived in the foreign country and provide supporting details.

- In the next section, indicate your connections to the foreign country, such as employment, property ownership, or family ties. Ensure to provide accurate descriptions.

- Review the tax residency requirements applicable to your situation. Confirm that you meet the criteria specified in the form.

- Once all relevant fields are completed, verify your information for accuracy. This step is crucial to avoid potential issues.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your form online today and ensure your tax benefits are properly accounted for.

In international taxation, a physical presence test is a rule used to determine tax residence of a natural or legal person. It may rely on having a place of business in the jurisdiction (for legal persons), or remaining in or out of the jurisdiction for a certain number of days each year (for natural persons).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.