Loading

Get Underwriting Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Underwriting Checklist online

This guide provides clear instructions on how to complete the Underwriting Checklist online. By following these steps, users will ensure a smooth and efficient submission process for underwriting.

Follow the steps to successfully complete the Underwriting Checklist.

- Click ‘Get Form’ button to obtain the Underwriting Checklist and open it in your preferred online editor.

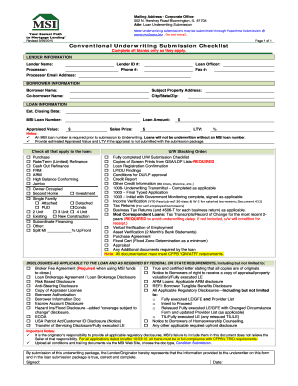

- Enter lender information in the designated fields, including lender name, processor, processor email address, lender ID number, phone number, loan officer, and fax number.

- Provide borrower information by entering the borrower's name, co-borrower's name (if applicable), subject property address, city/state/zip code.

- Complete the loan information section with the estimated closing date, MSI loan number, appraised value, loan amount, sales price, and loan-to-value (LTV) ratio.

- Check all boxes that apply to the loan type, including options such as purchase, refinance, owner-occupied, and property type.

- Fill out the underwriting stacking order with all required documents listed, ensuring each necessary item is checked off.

- Complete the disclosures section by checking applicable items required by federal or state requirements.

- Once all fields are filled out, review the checklist for accuracy and completeness.

- Save your changes, download a copy for your records, print a hard copy if needed, or share the completed form as necessary.

Complete your underwriting checklist online today for a streamlined submission process!

When trying to determine whether you have the means to pay off the loan, the underwriter will review your employment, income, debt and assets. They'll look at your savings, checking, 401k and IRA accounts, tax returns and other records of income, as well as your debt-to-income ratio.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.