Loading

Get Use This Form For Initial Determination Of Your Eligibility To Repay Eligible Federal Family

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Use This Form For Initial Determination Of Your Eligibility To Repay Eligible Federal Family online

Filling out the Use This Form For Initial Determination Of Your Eligibility To Repay Eligible Federal Family is an essential step for borrowers seeking to explore income-driven repayment options for federal student loans. This guide provides a clear, step-by-step approach to completing the form accurately and efficiently.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

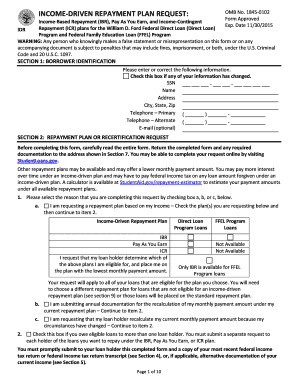

- Fill out Section 1: Borrower Identification by providing your Social Security Number, name, address, telephone numbers, and email address (optional). Ensure that all provided information is accurate and up-to-date.

- In Section 2: Repayment Plan or Recertification Request, select the reason for your request by marking the appropriate box (a, b, or c). Be sure to read all instructions and options carefully.

- If your situation includes a spouse, complete Section 3: Spousal Information, which requires your spouse's Social Security Number, name, and date of birth.

- Proceed to Section 4: Family Size and Federal Tax Information. Indicate your family size, and state whether you filed a federal income tax return in the last two years.

- If necessary, complete Section 5: Alternative Documentation of Income. Provide proof of your current income if applicable, or indicate if you do not have taxable income.

- Review and complete Section 6: Borrower Request Understandings, Authorization, and Certification. Ensure you understand the loan holder's policies and requirements and provide your signature and date.

- Return to Section 7 to identify where to send your completed request. Follow the provided mailing instructions carefully.

- Before finalizing, refer to Section 8: Instructions for completing the form for additional tips on formatting and submission requirements.

- Finally, save changes, download, print, or share the completed form as needed before submitting it to your loan holder.

Get started on your journey to financial relief by completing the necessary documents online today.

Your spouse's income is included in calculating monthly payments even if you file separate tax returns. However, a borrower may request that only his/her income be included if the borrower certifies that s/he is separated from his/her spouse or is unable to reasonably access the spouse's income information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.