Loading

Get Uncle Fed 2011 Form 709

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uncle Fed 2011 Form 709 online

Filling out the Uncle Fed 2011 Form 709 can seem complex, but with careful guidance, you can complete it efficiently online. This comprehensive guide will walk you through each section and field of the form, ensuring you understand exactly what information is required.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editing tool.

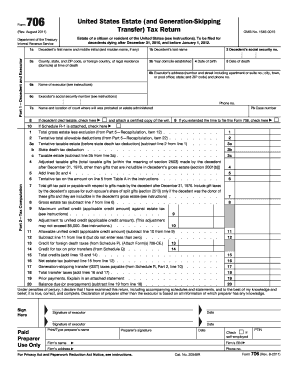

- Begin with Part 1, where you will enter the decedent's full name, social security number, and other identifying information such as the date of birth and date of death. Ensure all details are accurate to avoid processing delays.

- In the next section, fill out the executor's information, including their name, address, and social security number. This section is essential as it identifies the individual responsible for submitting the form.

- Proceed to Part 2, where you will compute the tax. Here, reference the total gross estate minus any exclusions and calculate the tentative total allowable deductions.

- Next, ensure you accurately report the taxable estate, which includes subtracting any state death tax deductions from the tentative taxable estate.

- Finally, review your entries for accuracy. Once confirmed, you may then save changes, download, print, or share the completed form as required.

Start completing your Uncle Fed 2011 Form 709 online today to ensure timely and accurate filing.

The Taxpayer First Act (TFA) of 2019 requires the IRS to provide digital signature options for Form 2848, Power of Attorney, and Form 8821, Tax Information Authorization. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.