Loading

Get Ptax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

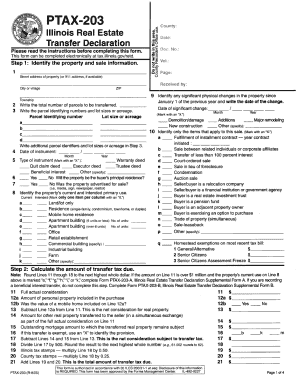

How to fill out the Ptax online

This guide provides users with a clear and comprehensive approach to completing the Ptax form online. Whether you are new to digital document management or have some experience, the following steps will assist you in navigating the form effectively.

Follow the steps to successfully complete the Ptax form online.

- Click ‘Get Form’ button to obtain the form and access it in your digital environment.

- Begin by entering your personal information in the designated fields. This includes your full name, address, and contact information. Ensure that all details are accurate to avoid processing delays.

- In the following section, specify the nature of your claim. You will need to provide relevant details that outline the reason for filing the Ptax. Follow the instructions carefully to ensure you select the appropriate options.

- If applicable, you'll be asked to upload any supporting documents related to your case. Make sure these files are complete and clearly labeled to streamline your application process.

- Review all the entered information thoroughly. It is important to check for any errors or omissions that could affect your submission.

- Once you are satisfied with the completeness of your form, proceed to save your changes. You may also choose to download, print, or share the completed Ptax form as needed.

Start filling out the Ptax form online today to ensure your submission is completed efficiently.

As per Bihar Professional Tax Act, 2011, individuals engaged in a business or profession are levied a Profession Tax of Rs. 2500 (as the maximum) and Rs. 1000 per annum (as the minimum).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.