Loading

Get Pdf Of Form Ct 1120 X

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pdf Of Form CT 1120 X online

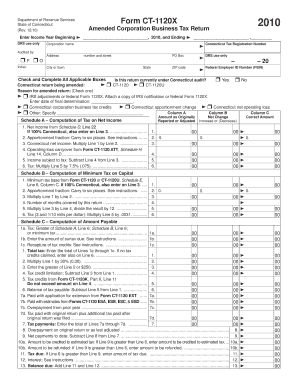

Filling out the Pdf Of Form CT 1120 X online can streamline your process for amending your corporation business tax return in Connecticut. This guide provides step-by-step instructions to help users accurately complete each section of the form.

Follow the steps to accurately complete the form

- Press the ‘Get Form’ button to access the form and open it within your online editor.

- Begin by entering the income year at the top of the form where indicated. Fill in the year starting and ending dates to ensure proper documentation.

- In the corporation name field, provide the official name of the corporation that is filing the amendment.

- Enter the Connecticut Tax Registration Number and Federal Employer ID Number (FEIN) in their respective fields.

- Check the applicable boxes indicating whether the return is currently under audit and select the Connecticut return being amended.

- Respond to the reason for the amended return by checking the appropriate box and provide any required details, like the date of final determination for IRS adjustments.

- Proceed to Section A for the computation of tax on net income. Complete the line items by following the form's instructions for calculations.

- Fill out Schedule B to compute the minimum tax on capital and input the relevant data as instructed.

- Complete Schedule C to determine the total tax, including any surtax, tax credits, or amounts payable.

- Fill in Schedule D for the computation of net income, ensuring that all necessary calculations are accurate.

- In the declaration section, a corporate officer must sign the form, providing their title and date to confirm correctness.

- Finally, save your changes, download, print, or share the completed form as needed to submit to the Department of Revenue Services.

Complete your form online efficiently and ensure timely submission for your tax amendment.

Interest and Penalties Interest is computed at 1% per month or fraction of a month on the underpayment of tax from the original due date of the return through the date of payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.