Loading

Get 2008 Form Ct 1120x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form Ct 1120x online

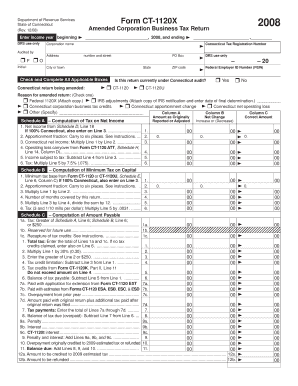

Filling out the 2008 Form Ct 1120x online is an essential process for corporations seeking to amend their business tax returns. This guide provides clear and supportive instructions, ensuring users can complete the form accurately and efficiently.

Follow the steps to complete the form online successfully.

- Press the 'Get Form' button to access the 2008 Form Ct 1120x and open it in your preferred online editor.

- Enter the income year in the designated fields, indicating the beginning and ending dates as required.

- Fill in the corporation name, Connecticut tax registration number, address, and federal employer ID number in the appropriate sections.

- Select whether the return being amended is currently under audit by checking the applicable box.

- Provide the reason for the amended return by selecting one of the options listed and attaching any necessary documentation.

- Complete Schedule A, which requires you to calculate your net income, apportionment fraction, and tax amount based on the values reported or adjusted.

- Proceed to Schedule B to determine the minimum tax on capital, entering the required figures and calculations.

- Fill out Schedule C with details about the taxes payable, including any tax credits and balances due.

- Complete Schedule D, calculating your net income and documenting any changes, ensuring to include additional explanations or schedules as necessary.

- Review the entire form for accuracy, then save your changes. You can choose to download, print, or share the completed document.

Begin completing your documents online today to ensure accuracy and efficiency in your tax amendments.

Business and individual taxpayers can use the TSC at .ct.gov/TSC to file a variety of tax returns, update account information, and make payments online. File Electronically: You can choose first-time filer information and filing assistance or log directly into the TSC to file returns and pay taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.