Loading

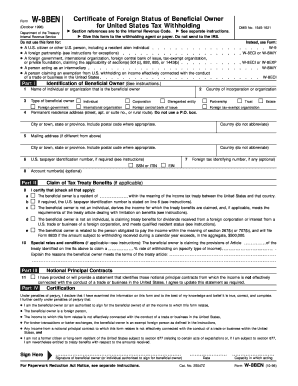

Get Form W-8ben (rev. October 1998) - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8BEN (Rev. October 1998) - IRS online

Filling out the Form W-8BEN is essential for foreign persons to certify their status as beneficial owners for U.S. tax withholding purposes. This guide provides a clear, step-by-step approach to complete the form accurately.

Follow the steps to successfully complete the Form W-8BEN.

- Click the ‘Get Form’ button to obtain the form and access it in the document editor.

- In Part I, provide the name of the individual or organization that is the beneficial owner. Ensure that the name is spelled correctly.

- Indicate the type of beneficial owner by selecting the relevant option from the list, such as individual, corporation, partnership, etc.

- Enter the country of incorporation or organization. This information is crucial for identifying the tax jurisdiction.

- Fill in the permanent residence address, ensuring it includes the street address, city or town, state or province, and postal code. P.O. boxes are not acceptable.

- If the mailing address differs from the permanent residence address, provide that information in the appropriate fields.

- If required, include the U.S. taxpayer identification number (TIN) on line 7. This may be an SSN or ITIN.

- Optionally, enter any foreign tax identifying number on line 8.

- In Part II, certify the appropriate claims for tax treaty benefits. Check all applicable boxes that apply to your situation.

- If claiming special rates and conditions, specify the type of income and the applicable withholding rate on line 10.

- In Part III, if applicable, agree to provide a statement regarding notional principal contracts, ensuring to update it as required.

- In Part IV, review all information you've entered, then sign and date the form to certify the accuracy of your claims.

- Once completed, you can save changes, download, print, or share the form as needed.

Start filling out your Form W-8BEN online today to ensure compliance with U.S. tax requirements.

Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.