Loading

Get Fbar Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fbar Form Pdf online

Filling out the Fbar Form Pdf correctly is essential for U.S. taxpayers with foreign financial accounts. This guide provides clear, step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the Fbar Form Pdf online.

- Click the ‘Get Form’ button to access the form and open it in your PDF editor.

- Begin by filling out your personal identification details including your name, address, and taxpayer identification number, if applicable. Ensure that all information is accurate and up-to-date.

- Proceed to Part I of the form, where you will indicate the accounts for which you must report. This includes accounts where you have a financial interest or signature authority.

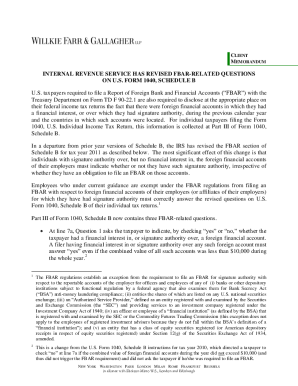

- In question 1 of Part III, check 'yes' or 'no' to indicate if you had a financial interest in, or signature authority over, a foreign financial account. Remember, report even if the total value of all accounts was below $10,000.

- For question 2 in Part III, indicate 'yes' or 'no' if you are required to file an FBAR. Review the FBAR form instructions if unsure about your filing requirements.

- In line 7b, list the countries where your foreign accounts are held, ensuring this information is thorough and accurate.

- Review your form thoroughly to ensure all responses are complete and correct. Save any changes made to the document.

- Finally, you can download, print, or share the completed form as needed. Ensure you keep a copy for your records.

Start filling out your documents online today to ensure compliance with FBAR requirements.

FBAR, or the Foreign Bank Account Report, is required for individuals who have foreign accounts that when combined equal to or exceeded $10,000 at any one time during the tax year. FBAR filing fee Includes up to 5 accounts. $50 for each additional 5 accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.