Loading

Get Alaska Quarterly Contribution Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alaska Quarterly Contribution Report online

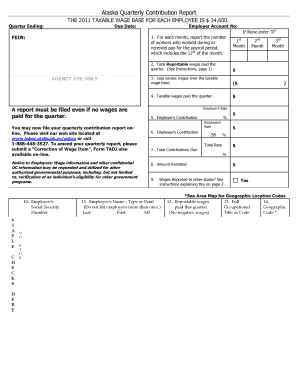

The Alaska Quarterly Contribution Report is a vital document for employers to report wages and contributions for their employees. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that you meet your reporting obligations accurately and efficiently.

Follow the steps to fill out the form seamlessly.

- Press the ‘Get Form’ button to access the Alaska Quarterly Contribution Report and open it for filling.

- Indicate the quarter ending date and the due date for the report in the appropriate fields. Ensure accuracy to avoid potential issues.

- Enter your Federal Employer Identification Number (FEIN) in the designated area. If you do not have a FEIN, please enter '0'.

- For each month, report the number of workers who worked or received pay during the payroll period that includes the 12th of the month. Ensure not to leave any boxes empty.

- Total the reportable wages paid this quarter in the corresponding field. This figure is critical for calculating contributions.

- Deduct any excess wages over the taxable wage base from the total reportable wages. This calculation is necessary for accurate reporting.

- Calculate the taxable wages paid this quarter by subtracting the excess wages from the total reportable wages. Enter this amount in the specified field.

- Fill in your employer's contribution rate and corresponding amount as well as the employee's contribution rate. Make sure to compute the total contributions due accurately.

- Indicate if any wages were reported to other states, following the instructions noted on the form. This is important for compliance.

- List each employee's name, Social Security Number, reportable wages, occupational title, and geographical codes in the spaces provided. Do not duplicate employee entries.

- Review the total reportable wages for all pages, ensuring it matches the total indicated in Block 2.

- Sign the report, certifying that the information submitted is true and correct. Include your printed name, title, and contact number.

- Once completed, you may save your changes, download the report, print it, or share it as needed.

Complete your Alaska Quarterly Contribution Report online today to ensure compliance and peace of mind.

Alaska Payroll Taxes: Unemployment Insurance Tax For 2022, the range is 1% to 5.4% on the first $45,200 in wages. You will also have to withhold 0.56% on the first $45,200 wages from every employee and pay it to the state as part of your payroll taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.