Loading

Get 2011 Va 8879c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Va 8879c Form online

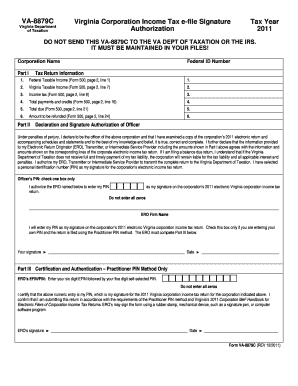

Filling out the 2011 Va 8879c Form online is an essential step for corporate officers authorizing electronic filing of income tax returns in Virginia. This guide offers clear and concise instructions to help users navigate the form with confidence and accuracy.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Enter the corporation name in the designated field at the top of the form. Ensure the name matches the official registration to avoid discrepancies.

- Input the Federal ID Number in the specified section. This number is crucial for identifying the corporation with the IRS.

- In Part I, fill in the Federal Taxable Income on line 1 as referenced from Form 500, page 2. This amount reflects the taxable income for the tax year.

- For line 2, input the Virginia Taxable Income also derived from Form 500, page 2, line 7. Ensure the figures are correct and up to date.

- On line 3, enter the income tax amount as detailed on Form 500, page 2, line 9. Accurate reporting in this section is necessary for effective tax processing.

- Fill in line 4 with the total payments and credits from Form 500, page 2, line 16. Verify that these amounts match your records.

- In line 5, indicate the total due as stated on Form 500, page 2, line 21. Double-check your calculations to ensure the accuracy of this figure.

- On line 6, input the amount to be refunded as documented on Form 500, page 2, line 24. This figure can be critical for potential refunds.

- In Part II, confirm your role as the corporate officer and proceed to authorize your Electronic Return Originator (ERO) to enter your personal identification number (PIN). Choose one of the two options regarding who will enter the PIN.

- Provide your selected PIN where indicated. Remember, it must be a unique sequence not consisting entirely of zeros.

- Sign and date the form in the designated spaces, ensuring that the signature corresponds to the title of the corporate officer.

- If applicable, Part III must be completed by the ERO following guidance for the Practitioner PIN method.

- Once all parts are accurately filled, save your changes, download the completed form, print a copy for your records, or share it as necessary with your ERO.

Complete your documents online efficiently and ensure compliance with Virginia's tax regulations.

Form 8878: This is the IRS e-file Signature Authorization used by filers of extension requests on Form 4868 or Form 2350. The latter form is for taxpayers living outside the United States. Form 8879: This is the IRS e-file Signature Authorization required for filers of Form 1040, 1040A, Form 1040EZ or Form 1040-SS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.