Loading

Get Nys Income Tax It200 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Income Tax It200 2012 Form online

This guide provides a clear and comprehensive walkthrough for users looking to complete the Nys Income Tax It200 2012 Form online. Whether you are a first-time filer or need a refresher, this guide will help you understand the required information and steps involved in filling out the form accurately.

Follow the steps to complete the Nys Income Tax It200 2012 Form online.

- Press the ‘Get Form’ button to obtain the form and open it in an editable format.

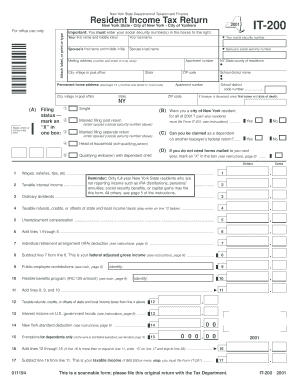

- Begin by entering your personal information, including your first name, middle initial, last name, and social security number. If you are married, provide your spouse’s information as well.

- Fill in your mailing address and, if different, your permanent home address. Make sure to include the apartment number, city, state, and ZIP code for both addresses.

- Indicate your filing status by marking an ‘X’ in the appropriate box. The options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Answer the questions regarding your residency and dependency status as outlined in the form.

- Proceed to report your income. Complete lines 1 to 5 by entering your wages, taxable interest, dividends, unemployment compensation, and any other relevant income.

- Calculate your federal adjusted gross income (AGI) by subtracting any deductions from your total income reported on line 6.

- Fill out the sections regarding New York State taxes, and apply any credits or deductions as necessary. This will involve identifying your taxable income and the applicable tax rates.

- Review the amount of total New York State tax withheld to ensure you have accounted for all the correct amounts.

- If eligible, fill in information for your refund request or any amount owed. Ensure that you complete banking information if you would like a direct deposit for your refund.

- Finally, sign the form. Ensure both you and your spouse (if filing jointly) sign and date the form before submitting.

- Once your form is complete, save any changes made, and you can choose to download, print, or share the form as needed.

Complete your Nys Income Tax It200 2012 Form online today to ensure timely and accurate filing.

To request copies of e-filed or paper returns for tax years 1990 and forward, complete and mail Form DTF-505, Authorization for Release of Photocopies of Tax Returns and/or Tax Information. Returns filed before 1990 are not available. We will send a photocopy of the return, if available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.