Loading

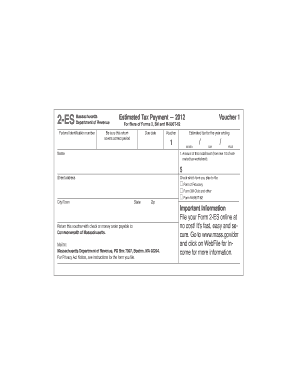

Get Form 2-es - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2-ES - Mass.Gov - Mass online

Filing your Form 2-ES can seem daunting, but this guide will provide you with clear and concise instructions to complete the form efficiently. By following the steps outlined here, you can ensure that your estimated tax payments are processed correctly.

Follow the steps to fill out the Form 2-ES successfully.

- Click ‘Get Form’ button to access the form and open it in your editing tool.

- Enter your federal identification number in the specified field. This number is crucial for identifying your tax records.

- Indicate the estimated tax payment period by entering the year in which you are making the payment.

- Fill in your name in the designated area, ensuring that it matches your legal documentation.

- Provide your full street address, including city/town, state, and zip code to ensure proper processing.

- In the checkbox section, select the form you intend to file: Form 2 for fiduciaries, Form 3M for clubs and others, or Form M-990T-62.

- Input the amount of this installment based on line 10 of the estimated tax worksheet.

- Upon completing the form, check all entries for accuracy to avoid delays in processing.

- You can save your changes, and then proceed to download, print, or share the form as needed.

Complete your Form 2-ES online to streamline your tax submission process today!

Payment: Mass. DOR, PO Box 7003, Boston, MA 02204.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.