Loading

Get Online 1120x Rhode Island Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Online 1120x Rhode Island Form online

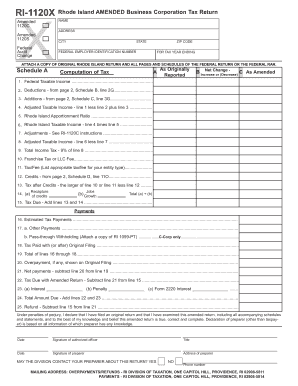

This guide provides clear instructions on completing the Online 1120x Rhode Island Form, designed for users who need to amend their business corporation tax return. Follow the detailed steps to ensure accurate submission and compliance.

Follow the steps to complete the Online 1120x Rhode Island Form effectively.

- Press the ‘Get Form’ button to access the Online 1120x Rhode Island Form and open it in the editor.

- Fill in the company name, address, city, state, ZIP code, and federal employer identification number in the designated fields.

- Specify the tax year ending date for which you are filing the amended return.

- Attach a copy of the original Rhode Island return along with all pages and schedules of the federal return or the federal RAR as required in the instructions.

- Complete Schedule A for the computation of tax. Enter the federal taxable income and indicate any changes, deductions, and additions as per the provided lines.

- Proceed to input the Rhode Island apportioned ratio and calculate the adjusted taxable income based on prior entries.

- List the appropriate credits in Schedule D, ensuring to attach supporting documentation as needed.

- Review and ensure that any necessary deductions and adjustments have been summarized correctly, as instructed in Schedules B and C.

- Finalize the form by ensuring all signatures and declarations are completed, including any authorization needed for preparer inquiries.

- Once you have completed all sections and verified accuracy, save your changes, and download a copy for your records, or share the completed form as required.

Complete your documents online for a streamlined filing experience.

With Online Taxes at OLT.com, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if you meet any of the following requirements: Your federal adjusted gross income for 2022 is between $11,100 and $73,000 or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.