Loading

Get Au 968

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Au 968 online

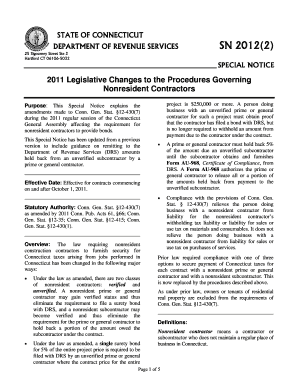

Filling out the Au 968, Certificate of Compliance, is an important step for nonresident subcontractors and their contractors to ensure compliance with Connecticut tax laws. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the Au 968 form online.

- Press the ‘Get Form’ button to obtain the Au 968 form and launch it in an online editing environment.

- Fill in the required information in the designated fields. This may include details such as the project name, contract price, and identification of the prime or general contractor.

- Provide the name and information of the unverified subcontractor seeking the Certificate of Compliance. Ensure all information is accurate to prevent delays.

- Review any instructions or guidelines provided within the form to ensure that all necessary documentation is included, such as proof of bond filing if applicable.

- Complete any additional sections as required, making sure to sign and date the form where indicated.

- After reviewing your completed form for accuracy and completeness, proceed to save your changes. You may also choose to download, print, or share the form as needed.

Complete and submit your Au 968 form online to ensure compliance and timely processing.

If your corporation carries out business or has the right to carry out business in Connecticut, you may have to file an annual Connecticut Corporation Business Tax Return, however there are some exemptions. The Corporation Business Tax is charged at a rate of 7.5 percent on taxable net income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.