Loading

Get Form 1099s Pdf

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099-S Pdf online

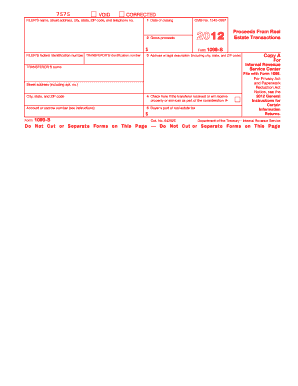

Filling out the Form 1099-S, which reports proceeds from real estate transactions, is an important task for the responsible party in a closing transaction. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to fill out the Form 1099-S Pdf online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the filer’s name, street address, city, state, ZIP code, and telephone number in the designated fields.

- Enter the date of closing in Box 1. This should be the exact date when the real estate transaction was completed.

- In Box 2, provide the gross proceeds from the real estate transaction, which typically equals the sales price.

- Input the filer’s federal identification number and the transferor’s identification number appropriately in the specified fields.

- In Box 3, input the address or legal description of the property transferred. Ensure this information is accurate.

- If applicable, check the box in Box 4 if the transferor received or will receive property or services as part of the transaction consideration.

- Provide the buyer's portion of real estate tax in Box 5, if relevant.

- Review all entered information for accuracy. Make necessary corrections before finalizing.

- Once all details are accurately filled out, save changes, download, print, or share the form as needed.

Complete your Form 1099-S Pdf online effortlessly and ensure accurate reporting.

If the 1099-S was for the sale of business or rental property, then this is reportable on IRS Form 4797 and Schedule D: From within your TaxAct return (Online or Desktop) click on the Federal tab. On smaller devices, click in the upper left-hand corner, then select Federal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.