Loading

Get Irs Form 8300 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8300 Fillable online

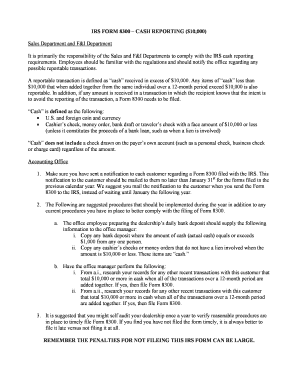

Filling out the IRS Form 8300 electronically can streamline your reporting process for cash transactions exceeding $10,000. This guide provides step-by-step instructions to ensure accurate completion of the form.

Follow the steps to fill out the IRS Form 8300 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the 'payer information' section at the top of the form. Enter the name, address, and taxpayer identification number (TIN) of the individual or entity making the payment.

- Next, provide 'reporting entity' details. This section includes the name and address of your business, as well as the employer identification number (EIN).

- Complete the 'cash transaction details' section by indicating the amount of cash received. Ensure that you specify whether this amount is equal to or exceeds $10,000.

- If applicable, document the nature of the transaction. This could include a description of goods or services provided, which helps clarify the context of the cash transaction.

- Review all provided information for accuracy before moving to any additional fields that might require further details about the transaction.

- Once all fields are completed and verified, save your changes and choose the option to download or print the filled form. It is essential to keep a record of this document for your records.

- Finally, submit the form to the IRS as required. You may also want to notify the payer using a notification letter by January 31st of the following year.

Start completing your IRS Form 8300 online today to ensure timely compliance with reporting requirements.

If I paid $15,000 cash for a car after saving for 15 years from gifts I was going to use for a big trip, the dealer sent form 8300 to gov'e, will this trigger an audit? No, the IRS does not penalize you for saving money. They only care that you report income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.