Loading

Get 2011 Form 990 Schedule L

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 990 Schedule L online

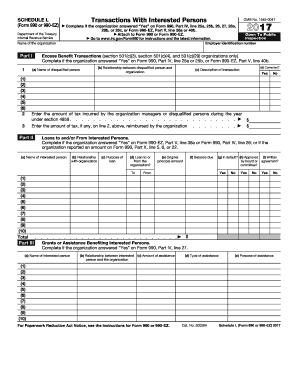

Filling out the 2011 Form 990 Schedule L is essential for organizations dealing with transactions involving interested persons. This guide will help you navigate the form easily and ensure compliance with IRS regulations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to acquire the form and open it in the designated online editor.

- Begin by entering the employer identification number at the top of the form. This number is vital for the identification of your organization.

- In Part I, provide details about excess benefit transactions if applicable. List the name of the disqualified person and describe the relationship with the organization.

- Indicate whether the transaction was corrected and provide details about the tax incurred by organization managers or disqualified persons.

- Proceed to Part II and report any loans to or from interested persons. Include their names, the relationship with your organization, and relevant amounts.

- In Part III, document any grants or assistance provided that benefit interested persons. Include the type of assistance and its purpose.

- Complete Part IV by detailing any business transactions involving interested persons, including the transaction amount and descriptions.

- Conclude by providing any supplemental information required in Part V, offering clarity on your responses.

- Once all sections are filled, save your changes, and download or print the form as needed for submission.

Start completing your document online now to ensure timely and accurate filing.

Schedule L is only used by taxpayers who are increasing their standard deduction by reporting state or local real estate taxes, taxes from the purchase of a new motor vehicle or from a net disaster loss reported on Form 4684.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.