Loading

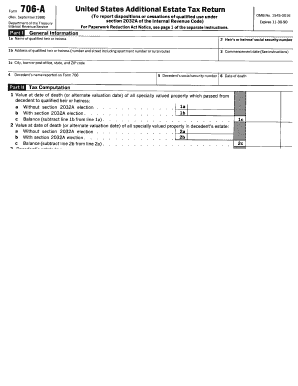

Get 1988 Irs Form 706

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1988 IRS Form 706 online

Filing the 1988 IRS Form 706 is an important process for reporting estate taxes. This guide will help you understand each component of the form and provide step-by-step instructions for completing it online, ensuring a smooth and efficient filing experience.

Follow the steps to successfully complete the 1988 IRS Form 706 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the first section of the form, which includes basic information about the decedent. Fill in their name, date of birth, and date of death.

- Complete the next sections that require the identification of the estate's executor. Provide their name, address, and contact information.

- Navigate to the assets section where you will report the value of the decedent's estate. This includes real estate, bank accounts, stocks, and other valuable assets.

- Fill out deductions in the appropriate section, detailing any debts or taxes owed by the deceased at the time of death.

- Review the summary of the estate tax calculation, paying careful attention to the figures you have entered to ensure accuracy.

- Finally, save your changes, then proceed to download, print, or share the completed form as needed.

Start filling out your document online today!

Generally, the Gross Estate does not include property owned solely by the decedent's spouse or other individuals. Lifetime gifts that are complete (no powers or other control over the gifts are retained) are not included in the Gross Estate (but taxable gifts are used in the computation of the estate tax).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.