Loading

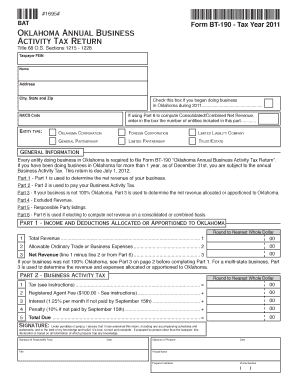

Get Oklahoma Annual Business From Bt 190 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Annual Business From BT 190 2011 Form online

Filling out the Oklahoma Annual Business Activity Tax Return (Form BT-190) online is a systematic process that ensures compliance with state tax obligations. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, regardless of your experience level.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing tool.

- Enter your Taxpayer FEIN, name, address, city, state, and zip code in the designated fields.

- If you started your business in Oklahoma during 2011, check the appropriate box.

- Fill in the NAICS code that corresponds with your business activities.

- Select your entity type from the list provided, including Oklahoma Corporation, Limited Liability Company, or Partnership.

- Complete Part 1, which determines the net revenue of your business. Enter total revenue and allowable ordinary trade or business expenses, then calculate the net revenue.

- Proceed to Part 2 to calculate and report your Business Activity Tax due. Include any applicable fees, interest, and penalties.

- If your business operates in multiple states, complete Part 3 to allocate or apportion revenue to Oklahoma.

- Fill in Part 4 to report any excluded revenues.

- Complete Part 5 by listing all responsible parties, including their names, titles, addresses, and Social Security Numbers/FEIN.

- If applicable, fill out Part 6 for consolidated or combined net revenue computations.

- After completing all sections, review the entire form for accuracy and completeness.

- Finally, save your changes, and download, print, or share the completed form as needed.

Complete your documents online to ensure timely and accurate submission.

Businesses must also be registered with the Oklahoma Tax Commission in person or using their web address shown above. Federal employer identification numbers (EIN) are obtained through the website of the Internal Revenue Service at https://sa1.www4.irs.gov/modiein/individual.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.